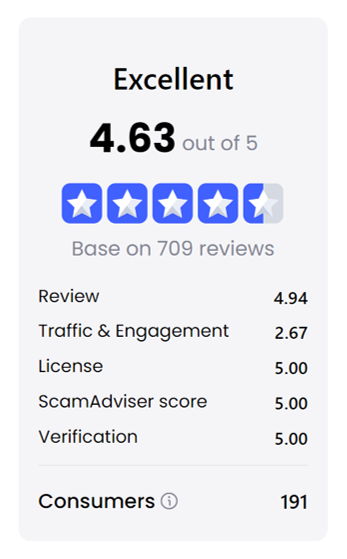

TrustFinance aims to promote transparency and trust in the financial industry through its TrustScore Calculation system. We provide users with verified reviews and valuable insights about financial companies worldwide. To enhance the credibility and reliability of our platform, we have developed a comprehensive TrustScore system. This numerical representation of a company’s trustworthiness is calculated using five key factors: user reviews, website traffic, licensing, ScamAdviser assessments, and verification status. With TrustScore Calculation, users can make informed decisions based on reliable and accurate trust indicators.

More information of TrustScore and Star Ratings Explaination

User Reviews

The first factor in determining the TrustScore is user reviews. As a review platform, TrustFinance places significant importance on authentic and trustworthy user feedback. To ensure the integrity of the reviews, we utilize advanced AI algorithms that detect and filter out potentially fraudulent or scam reviews.

Our AI system employs a comprehensive set of criteria to assess the credibility of user reviews. Here are some of the factors we consider:

Email Verification:

- Possible domain typo: Identifying potential misspellings or errors in the email domain.

- Email pattern match: Analyzing email patterns to detect suspicious or unusual formats.

- Suspicious email format: Identifying email addresses that exhibit suspicious characteristics.

- Customer is using Private Email Relay Service: Verifying if the user is using a private email relay service, which could indicate potential anonymity.

Domain Analysis:

- Domain’s registrar name is high risk: Assessing the risk level associated with the domain’s registrar.

- Website does not exist on email’s domain: Checking if the provided email domain corresponds to an existing website.

- Suspicious top-level domain (TLD): Identifying email addresses with unusual or suspicious TLDs.

Email Server Verification:

- SPF record does not exist: Verifying if the domain has Sender Policy Framework (SPF) records, which help prevent email spoofing.

- Mail server’s DMARC is not enforced: Checking if the domain’s mail server enforces DMARC policies.

- Mail server is configured to accept all: Detecting if the mail server accepts emails from any source without proper verification.

Email Address Analysis:

- Email is not similar to user’s full name: Assessing if the email address matches the user’s provided full name.

- Presence of 5 or more digits in email handle or username: Identifying email addresses with an excessive number of digits.

- Domain is disposable: Verifying if the domain is associated with disposable or temporary email services.

- Email API result is unknown: Assessing the result of the email API query to determine its reliability.

Domain Registration and Online Profile History:

- Duration of domain registration and online profile history: Analyzing the length of time a custom domain has been registered and if any online profiles or data breaches are associated with it.

- Domain being a free provider: Evaluating the reputation of free email providers and the presence of online profiles or data breaches associated with them.

- Domain risk level: Assessing the overall risk level associated with a domain.

- Domain registration status: Verifying if the domain is registered or not.

Other Factors:

- Email deliverability: Checking if the email address is deliverable and active.

- Sentiment analysis: Analyzing the sentiment expressed in the reviews.

- Relation with the score: Understanding the correlation between the sentiment expressed in reviews and the TrustScore.

- Meaning of words: Assessing the meaning and context of words used in reviews.

- IP address, User Agent, and Device: Examining the IP address, user agent, and device information associated with the review.

- Multiple email detection: Identifying cases where a single user submits multiple reviews using different email addresses.

By carefully analyzing these factors, TrustFinance ensures that only genuine and reliable user reviews contribute to the calculation of a company’s TrustScore. This commitment to authenticity allows users to make well-informed decisions based on trustworthy feedback.

Website Traffic

How We Calculate the Score of Each Website by Traffic

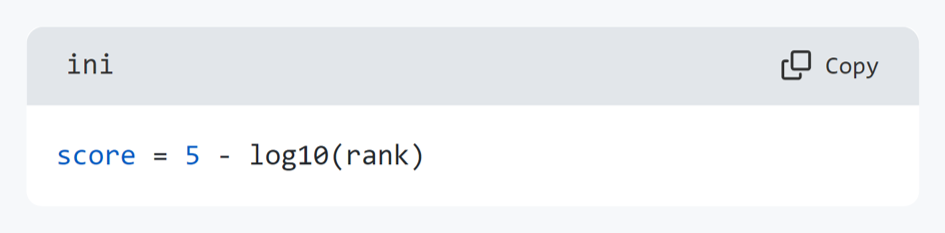

Website traffic is a crucial metric for determining the popularity and relevance of a website. While there are many ways to measure website traffic, one common method is to use the Alexa Traffic Rank. In this article, we will discuss how to calculate the score of each website based on its traffic volume using the Alexa Traffic Rank, with a maximum score of 5.

Alexa Traffic Rank

Alexa Traffic Rank is a tool that ranks websites based on their popularity and traffic volume. The rank is calculated by analyzing the traffic patterns of millions of users who have installed the Alexa toolbar or extension. The rank is updated daily, with the most popular websites receiving the lowest ranks.

The Alexa Traffic Rank ranges from 1 to millions, with 1 being the highest score possible. However, this scale can be difficult to interpret, as the difference between ranks can be quite large at higher ranks. To make the scores more intuitive, we can use a logarithmic scale to convert the ranks into a 1-5 scale.

Calculating the Score

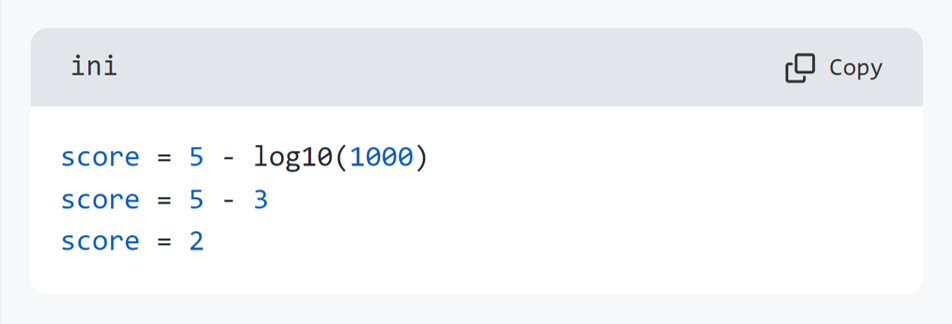

To calculate the score of each website based on its Alexa Traffic Rank, we can use the following formula:

In this formula, rank refers to the Alexa Traffic Rank of the website. The log10 function is used to scale the score logarithmically, so that the difference between ranks is more pronounced at higher ranks.

For example, let’s say that a website has an Alexa Traffic Rank of 1000. To calculate its score using the formula above, we would do the following:

Therefore, this website would receive a score of 2 out of 5 based on its traffic volume.

Conclusion

Calculating the score of each website based on its traffic volume is an important task for understanding the popularity and relevance of websites. By using the Alexa Traffic Rank and a logarithmic scale, we can convert raw traffic data into intuitive scores that are easy to interpret.

License

TrustFinance assigns a score for the License factor to companies operating in industries that require licenses. This score reflects the level of trust associated with the licenses they hold. By providing this information, TrustFinance aims to empower users with valuable insights for making informed decisions about each company’s trustworthiness.

We categorize licenses into different grades, each indicating a varying level of trust:

GRADE A LICENSE

Both institutions and consumers highly trust the license in grade A. They operate more extended and are more challenging to hold than others. They have strict rules which the company needs to comply with.

GRADE B LICENSE

Just one point was deducted from grade A. The license in grade B is also trusted, but the difference between them is It will slightly get less complicated than in grade A.

GRADE C LICENSE

The license in grade C is also safe to rely on, but we recommend that you be careful with your chosen company. You should inspect the company information before investing.

GRADE D LICENSE

The license in grade D is easily held and has yet to become widespread. If your chosen company holds a license in this grade, you should carefully contemplate it.

TrustFinance displays the respective grade sign for each license held by a company. This visual representation allows users to gain a better understanding of the trustworthiness of each company, facilitating more informed decision-making.

By considering the license grade of a company, users can assess the level of trust associated with its operations and make well-informed choices that align with their preferences and risk tolerance.

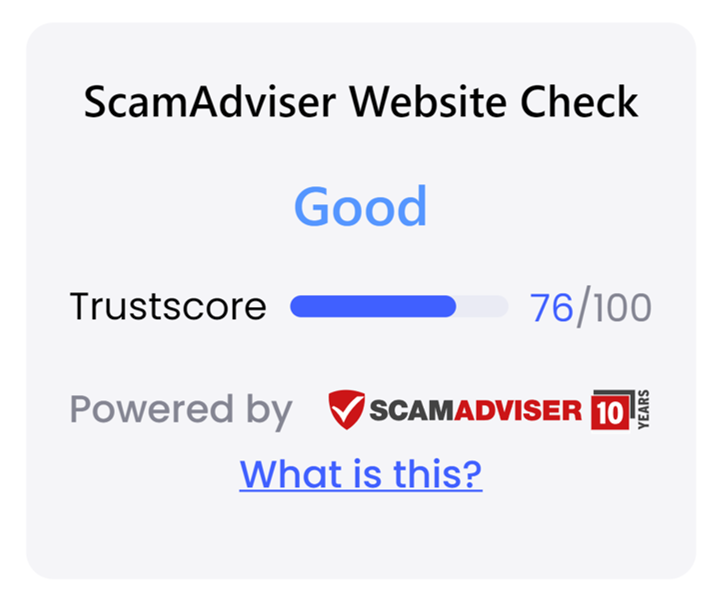

ScamAdviser Assessment

TrustFinance collaborates with ScamAdviser, our trusted partner in consumer protection, to enhance the TrustScore calculation. The ScamAdviser score, which evaluates various domain-related factors, is incorporated into TrustScore to provide a comprehensive assessment of a company’s trustworthiness. This integration ensures that TrustFinance considers not only internal factors but also information from external sources.

ScamAdviser considers several key factors when calculating a company’s score, including:

- Domain information: This includes the domain name itself and relevant details associated with it.

- Trust score (ranging from 0 to 100): The overall trustworthiness rating assigned to the domain.

- Reasons for the trust score: ScamAdvisor provides insights into the specific factors that contribute to a particular trust score.

- WHOIS data: Comprehensive information about the domain ownership and registration.

- Aggregated consumer reviews: Feedback and reviews from consumers that have been gathered and analyzed.

- Facebook comments: Comments and interactions related to the domain found on Facebook.

- Technologies used: Evaluation of the technologies employed by the company or website.

- Others: ScamAdvisor considers additional relevant factors to ensure a comprehensive assessment.

By incorporating ScamAdviser’s assessment into the TrustScore, TrustFinance aims to provide users with a holistic view of a company’s trustworthiness. This integration enables users to make more informed decisions based on not only TrustFinance’s internal criteria but also the insights and evaluations derived from ScamAdviser’s extensive analysis.

With the combined power of TrustFinance’s internal factors and the additional information from ScamAdviser, users can have increased confidence in their decision-making process, knowing that multiple trusted sources contribute to the assessment of a company’s trustworthiness.

Verification Status

One of the key factors in calculating the TrustScore on TrustFinance is the Verification Status. This factor assigns a score to companies that have undergone the verification process to confirm their legitimacy, existence, and adherence to TrustFinance’s standards. The Verification Status plays a vital role in ensuring that users can trust the companies listed on our platform.

Confirmation of Legitimacy and Existence

Through the verification process, TrustFinance verifies that the companies on our platform are official, legal, and genuinely exist. This confirmation instills confidence in users, knowing that the companies they engage with are legitimate entities operating within the financial industry.

Green Verified Badge: A Symbol of Trust

Upon successful verification, companies receive a green verified badge displayed prominently on their profile page. This badge serves as a visual indicator to users that the company has undergone the verification process and met TrustFinance’s stringent criteria for trustworthiness. Seeing the green verified badge boosts user confidence and helps them make informed decisions when engaging with verified companies.

Engaging with User Reviews for Transparency

Verified companies not only gain the green verified badge but also have the privilege of responding to user reviews. This feature allows companies to engage directly with user feedback, address concerns, and provide clarifications. By enabling this open line of communication, TrustFinance fosters transparency and accountability, further enhancing trust between companies and users.

By assigning a score for the Verification Status factor, TrustFinance ensures that users can rely on the legitimacy and trustworthiness of the companies listed on our platform. The green verified badge and the ability to respond to user reviews contribute to a transparent and trustworthy environment where users can confidently make decisions and engage with verified companies.

Overall

TrustFinance stands as a pioneering platform in the financial industry, armed with a robust algorithm and advanced technology to calculate the TrustScore. Our commitment to transparency and trust is reinforced by our meticulous evaluation process, incorporating user reviews, website traffic analysis, license grades, ScamAdviser assessments, and verification status. Through this comprehensive approach, we ensure that our TrustScore is a reliable and accurate measure of a company’s trustworthiness. By harnessing cutting-edge technology, we empower consumers to make informed decisions, fostering a trusted and secure financial landscape for all.