Exploring the Forward Market

A forward contract is a type of derivative that involves an agreement between two parties to buy or sell an asset at a predetermined price on a future date. Understanding this market can help brokers make better decisions in trading and investing.

What is a Forward Market?

A forward market is an over-the-counter (OTC) market where traders can buy and sell contracts for future delivery of an asset at a predetermined price. As mentioned, this type of transaction involves two parties agreeing to exchange an asset at some point in the future. The contract outlines all of the details of the trade, such as when and where it will take place, what kind of asset will be exchanged, and how much each party will pay or receive in terms of cash or other assets.

Forward contracts help dealers lock in trade pricing before they happen. Buying assets at prices they like provides traders more control over their investments. It also protects them from price swings after investing.

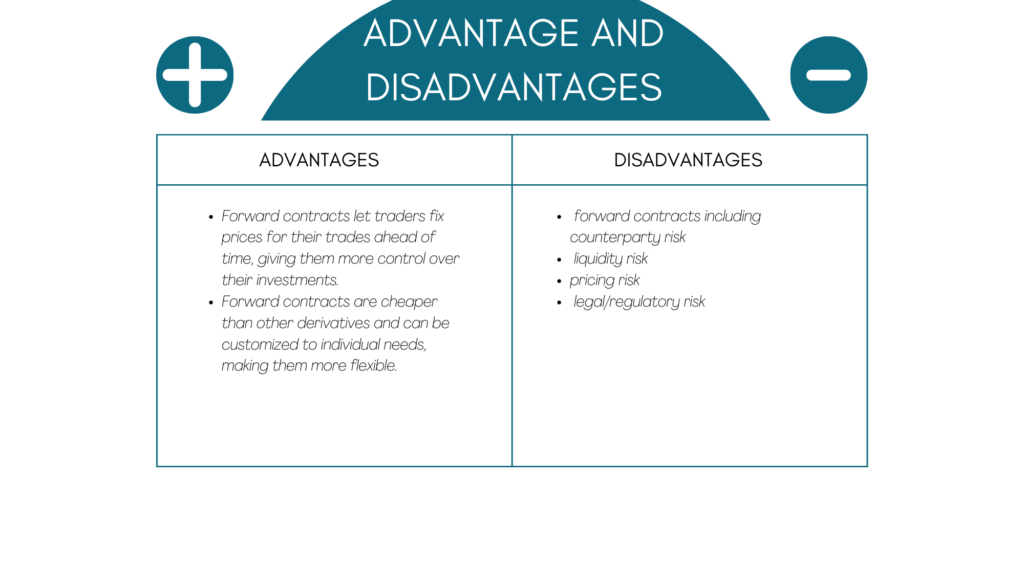

Advantages and Disadvantages

Forward contracts have advantages such as allowing traders to lock in prices before trades occur, providing control over investments, and being less expensive than other derivatives with more flexibility for structuring deals. However, forward contracts also carry risks, including counterparty, liquidity, pricing, and legal/regulatory risks.

Conclusion

Forward markets have benefits for investors seeking more control and flexibility, but they also have risks that should be considered before entering contracts. By understanding and mitigating risks, brokers can safely utilize forward transactions and reap their benefits.